- TOP

- Investor Relations

- Sustainability

- Environment

- Climate Change

Climate Change

Disclosures based on the TCFD framework

We designated environmental response as one of our materiality (core issues) and in June 2022 we announced our support for recommendations by the Task-Force for Climate-related Financial Disclosures (TCFD). In accordance with the TCFD approach, we conducted scenario analyses to identify the risks and opportunities associated with our business activities, and are working to incorporate these into our management strategy.

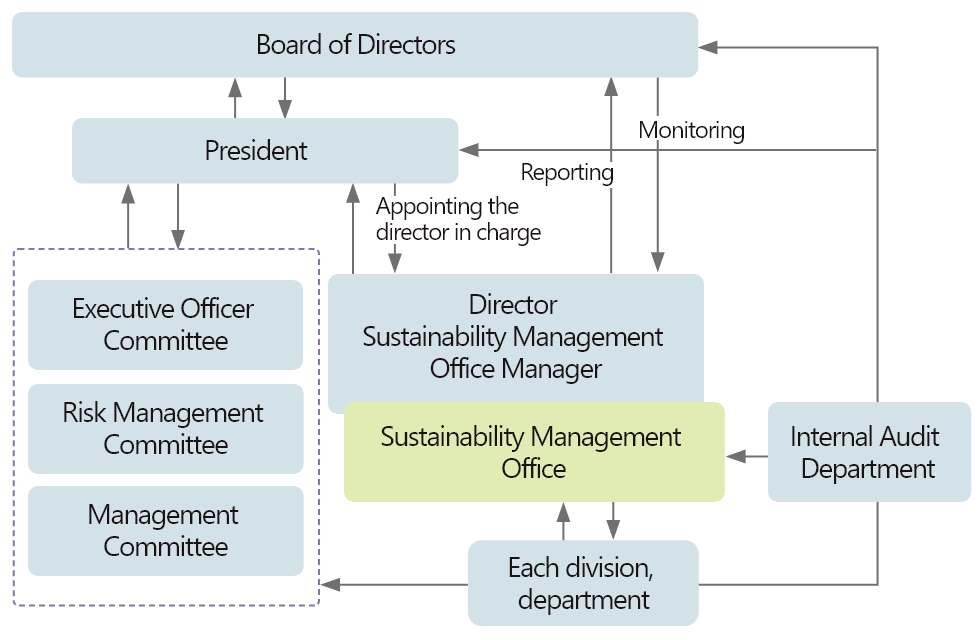

Governance

We position responding to environmental issues, including climate change, as one of our core management issues.To promote sustainability management uniformly throughout our Group, on April 1, 2022, we established the Sustainability Management Office as an organization directly overseen by the President. The President appoints Executive Officer in charge of Sustainability Management Office from among the Directors who are also members of the Med-term Management Planning Office. The officer in charge, through the Sustainability Management Office, will work in accordance with the Basic Policy on Sustainability created by the Board of Directors. The Sustainability Management Office collaborates with each department to analyze and assess risks and opportunities related to climate change, etc., identifies important issues, plans and formulates responses to sustainability issues, including the environment and human rights, and sets goals. The director in charge, who is an officer, attends important meetings such as Risk Management

Strategy

Scenario analysis of climate-related risks and opportunities by each department and the Sustainability Management Office

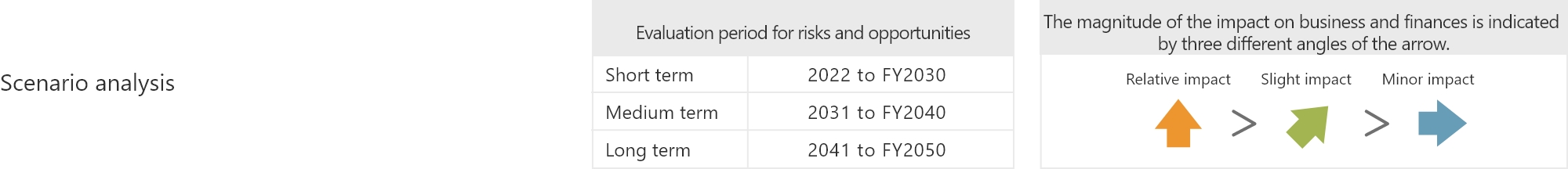

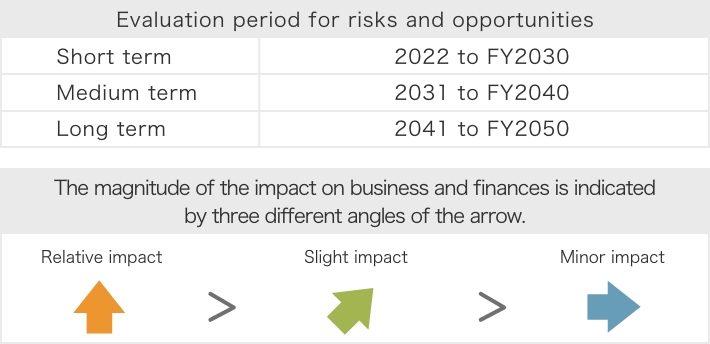

In order to assess the priority of climate-related risks and opportunities, each department and the Sustainability Management Office identified issues that impact business and divided them into the categories of Transition Risks, Physical Risks, and Opportunities. We then defined and evaluated scenarios, to select 11 assessment items. During the assessment, we evaluated the business and financial impact with consideration given to the 4°C Scenario*1 and 1.5°C Scenario*2 announced by the United Nations Intergovernmental Panel on Climate Change (IPCC). AS ONE’s business model involves procuring and selling products from various suppliers based on customer demand. Since we have almost no fixed manufacturing facilities, we are able to respond to changes relatively flexibly. As such, changes in demand viewed as risks can also be viewed as new opportunities. We have partially incorporated strategies based on these analyses into the business strategies outlined in our Medium-Term Management Plan FY2025-FY2027 (expanding e-commerce, expanding delivery services, etc.) and are proceeding to implement these strategies.

*1. 4°C scenario: A scenario in which temperatures rise by around 4°C compared to pre-industrial levels.

*2. 1.5°C scenario: A scenario in which the increase in global average temperature at the end of the 21st century is kept below 1.5°C compared to pre-industrial times.

Scenario analysis

| Risk categories |

Risk/opportunity categories and details | Time axis | Impact assessment | ||||||

| Categories | Details | Impact on AS ONE |

Short | Medium | Long | 1.5°C scenario |

4°C scenario |

||

| Risks | Transition | Policy/legal | Rising product purchase prices due to measures to reduce CO2 emissions and the introduction of a carbon tax | Costs ↑ | ● | ● |  |

|

|

| Technology | PB product development costs for decarbonization and an increase in capital investments associated with the adoption of decarbonization technology in logistics | Costs ↑ | ● | ● |  |

|

|||

| Market | Decrease in demand for consumables that become waste, in line with the development of various technologies that can integrate safety, convenience and CO2 emission reduction. | Sales ↓ | ● | ● |  |

|

|||

| Reputational | Loss of reputation among customers and the capital markets due to lagging behind other companies in disclosing information on GHG emissions reductions in logistics, products and services. | Sales ↓ | ● | ● |  |

|

|||

| Physical | Acute | Costs related to inventory damage, operational stoppages, production decreases, and facility restoration incurred due to natural disasters. | Costs ↑ | ● | ● | ● |  |

|

|

| Chronic | Costs associated with supply constraints caused by supply chain disruptions caused by delays in procuring alternative products, etc. | Costs ↑ | ● | ● |  |

|

|||

| Opportunities | Resources | Shift of purchasing behavior from ownership to rental, reusing products, recycling, and customer retention through circulation. | Sales ↑ | ● | ● |  |

|

||

| Energy | Gaining a competitive advantage through providing new services that utilize a product database, such as displaying CO2 Emissions from production to delivery to the customer. | Sales ↑ | ● |  |

|

||||

| Market | Solving decarbonization issues through R&D is essential, so expenditures will increase in our main market R&D. | Sales ↑ | ● | ● |  |

|

|||

| Product services | Improving loading efficiency through shortening delivery distances, expanding the company’s own delivery services that can be delivered using eco packaging with less waste wrapping materials, and improving efficiency through joint logistics. | Costs ↓ | ● | ● | ● |  |

|

||

| Resilience | Building a diversified supply chain that distributes risks will increase trust in suppliers capable of providing stable supply. | Sales ↑ | ● | ● |  |

|

|||

Risk Management

We engage in risk management based on the policies outlined in our Risk Management Regulations, which detail risk prevention measures for incidents with the potential to interrupt business operations and appropriate responses in the event a risk incident occurs. For risks associated with climate change, each department identifies inherent risks from the upstream to the downstream along the value chain and works to address those risks (transfer, avoidance,diversification, mitigation, etc.). The Sustainability Management Office coordinates company-wide efforts, evaluates and identifies the importance of transition risks and physical risks, and submits reports to the Risk Management Committee once a year. The Risk Management Committee comprehensively coordinates responses to relevant risks and perform other necessary matters related to risk management.

Indicators and targets

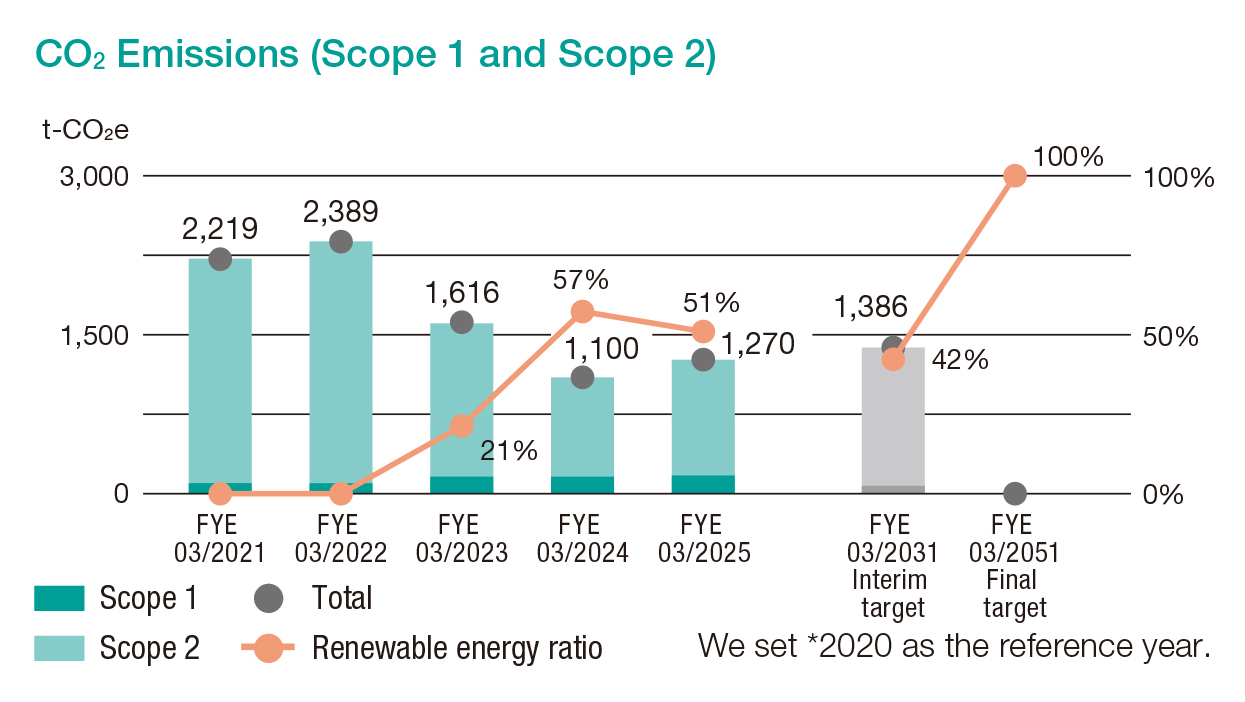

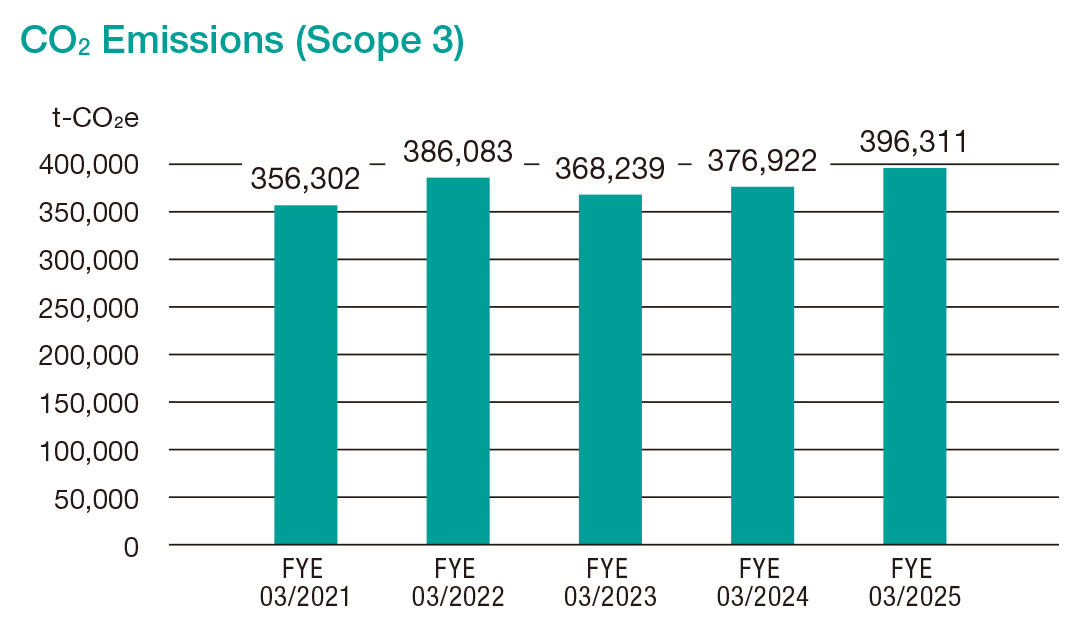

AS ONE supports the Renewable Energy 100 Declaration RE Action and has set targets for reduction in Scope 1 and Scope 2 emissions and for employment of renewable energy at 42% in FYE 03/2031 and 100% in FYE 03/2051,

compared to FYE 03/2021 as the reference year.

We introduced Green Power Certificates for electricity derived from renewable energy sources in FYE 03/2023 and have made progress on the renewable energy employment rate, reaching 51% in FYE 03/2025. For Scope 3, we are considering prioritizing measures that can contribute to reduction of Category 1 emissions, including collaboration with our suppliers since Category 1 emissions from purchasing the more than 12.4 million products we handle account for roughly 80% of Scope 3 emissions. For example, we ask our main suppliers to provide primary data and work with the relevant departments in AS ONE on coordination.

We set *2020 as the reference year.

CDP

We respond to CDP, an NGO that encourages companies and local governments to disclose environmental information.