Corporate Governance

Basic Approach

Our basic approach to corporate governance is to thepursue management efficiency to maximize corporatevalue while also reinforcing corporate ethics andincreasing management transparency to increase thetrust we earn from all our stakeholders.

Board of Directors

Corporate Governance System

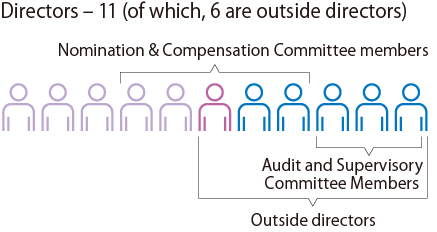

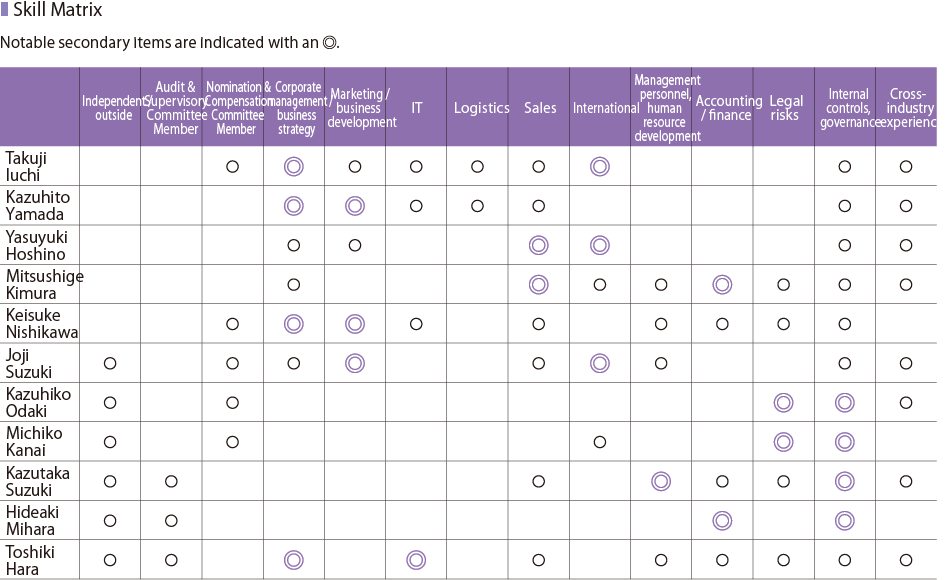

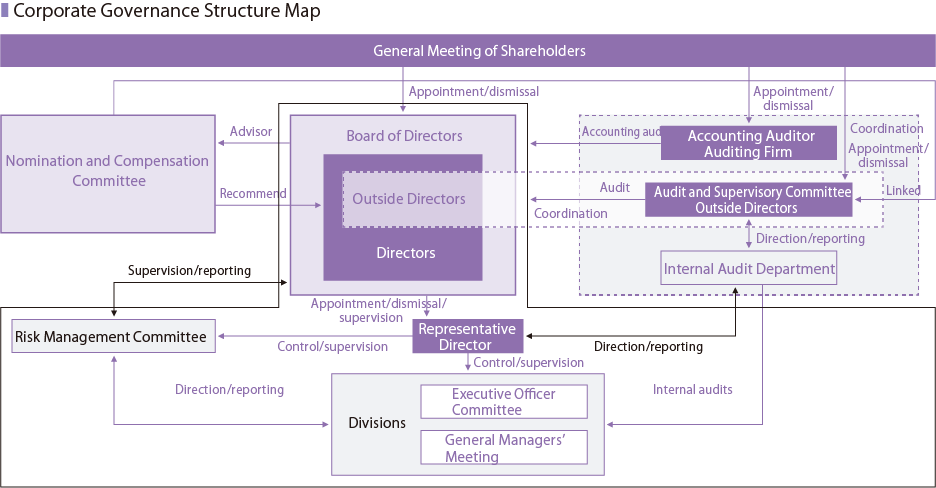

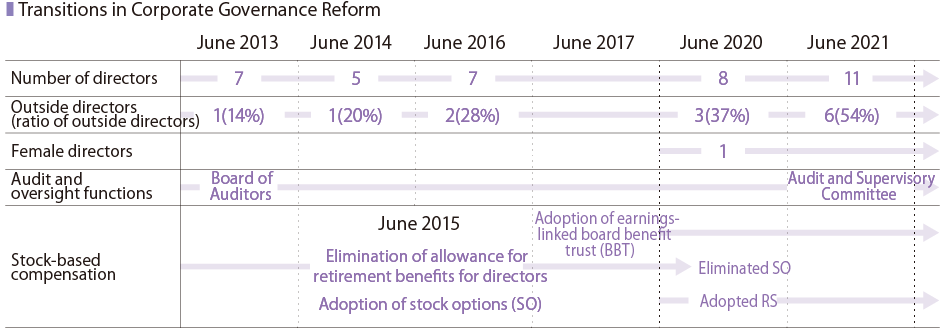

The 60th General Meeting of Shareholders held onJune 25, 2021 approved the necessary changes to theArticles of Incorporation, which enabled us to shiftfrom a company with a Board of Auditors to acompany with and Audit and Supervisory Committee.The adoption of this corporate governance structurestrengthens oversight functions by making Audit andSupervisory Committee Members, the peopleresponsible for the audit and oversight of businessexecution by directors, members of the Board ofDirectors. This strengthening of our monitoringfunctions will further enhance corporate governanceand enable the broad consignment of businessexecution tasked to the Board of Directors to variousdirectors. This shift will not only increase the speed ofdecision-making related to business execution, it willalso allow the Board of Directors to focus on decisionsrelated to critical management matters such as theMedium-Term Management Plan. Overall, this shift willcontribute to improvement in our corporate value.We also established a Nomination andCompensation Committee to increase transparencyfor the evaluation and decision-making processesrelated to director nomination and compensation.

Outside Directors’ Role and Independence

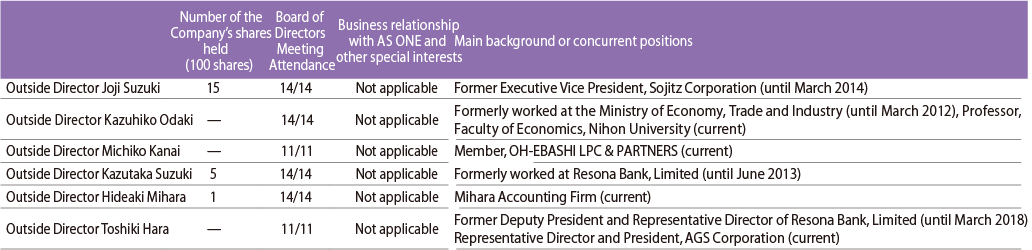

AS ONE currently appoints six outside directors. All are registered with the Tokyo Stock Exchange as independent outside directors.

As indicated above, Outside Directors KazutakaSuzuki and Toshiki Hara previously worked at ResonaBank, Limited, with which AS ONE has financialtransactions. However, as of the end of March 2021,the AS ONE Group total loan balances were 4,700million yen, representing 5.0% of total assets, and totalloans represent roughly 32.8% of total cash anddeposits. As such, we have a low dependence onloans. Furthermore, loans from the above bank were1,840 million yen, roughly 2.0% of total assets, andloans from the above bank can be sufficientlysubstituted via other means of procurement.Based on the above and the Criteria for Determiningthe Independence of Outside Directors outlinedbelow, it is our judgement that there are no problemswith the independent status of both Mr. Suzuki and Mr.Hara as outside directors, and there are no concernsof any conflicts of interest between generalshareholders and the Company.

Officer Compensation

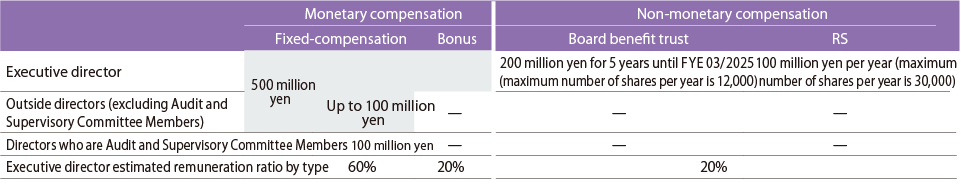

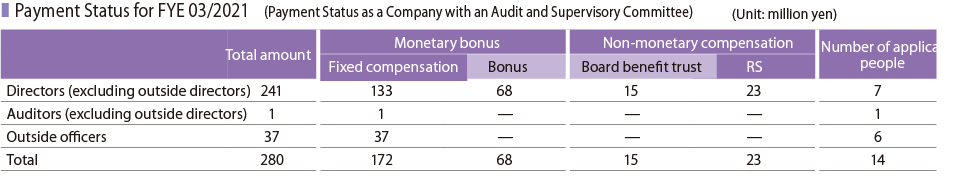

The maximum amount of compensation for directors wasdetermined at the 60th General Meeting of Shareholdersheld in June 2021. The appropriateness of officercompensation is then deliberated by the Nomination andCompensation Committee, which is comprised of a majorityof independent outside directors, before a final decision ismade by the Board of Directors.The types of compensation consist of fixed compensation (cash), earnings-linked compensation (cash bonuses),earnings-linked non-monetary compensation in the form ofa board benefit trust (BBT), and non-monetary share-basedcompensation subject to transfer restrictions (RS).Furthermore, outside directors and directors who are Auditand Supervisory Committee Members receive only fixedcompensation.Compensation limits are as indicated in the following table.

Bonuses are based on consolidated operating profit with afinal decision made based on a comprehensive evaluationof dividends, employee bonus levels, trends among othercompanies, medium- and long-term results, and pastpayouts.The board benefit trust (BBT) allocates points equivalentto stock based on stock benefit regulations outlined by theCompany and condition to the achievement of net salesand operating profit goals set forth for each fiscal year plan of the Medium-Term Management Plan.To promote objectivity and transparency, the Nominationand Compensation Committee are consulted in advanceon specific individual renumeration by type andcompensation amounts, after which the Board of Directorsvotes to consign final decision-making to the President,who gives due respect to the recommendations of theNomination and Compensation Committee.

The performance criteria used in the calculation ofbonuses is operating profit. The performance criteriaand earnings used as the basis for BBT calculationsare as shown in the table to the right.

Corporate Governance Report

Dialogue with Stakeholders

As is represented in our Company name, we strive towork as one with our users, dealers, and supplierstowards creating new value. Our Sales Division,Customer Support Division, and Purchasing Divisionstake the lead in engaging in daily communication withthese stakeholders to promote daily improvements.The Public and Investor Relations Department workswith the Director in charge of the AdministrationDivision and our President to facilitate communicationwith shareholders and investors. During FYE 03/2021,we held meetings with a total of more than 300institutional investors. Recently, we are increasingengagement with ESG investors, which has enabled usto partake in valuable exchanges of opinion that welater reflect in management.

Risk Management

Basic Approach

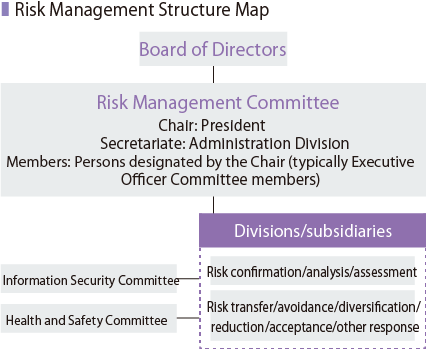

We engage in risk management based on the policiesoutlined in our Risk Management Regulations, whichdetail risk prevention measures for incidents with thepotential to interrupt business operations andappropriate responses in the event a risk incidentoccurs. The Risk Management Committee, which ischaired by the President, serves as the entity in chargeof risk management. This Committee holds regularmonthly meetings, or as necessary in cases of anemergency, to monitor the status of risk managementstructure creation and reports on risk managementactivities received from business divisions. At leastonce every three months, the Committee issuesreports to the Board of Directors on the status of riskmanagement but issues a report immediately in theevent of a serious incident.Divisions work to ascertain, analyze, and assesslatent risks in order to prevent risks before they occur.In accordance with Division Risk ManagementParameters, we set a baseline amount calculated bymultiplying ordinary profit plan figures by a specificcoefficient. Any risks with an estimated impactexceeding the calculated amount are reported to theRisk Management Committee.

Information Basic Approach Security Management

AS ONE has over 3,700 suppliers, 4,500 dealers, and acustomer base of researchers comprised of AXELmembers and ocean users who rely on the timelyorder processing and shipment of the more than fivemillion products we offer. To fulfill our commitment asa hub for research and medical supplies, we take fulladvantage of various IT systems. We also possessmassive information assets ranging from digitalinformation such as our product and price masterdatabases to analog confidential information. Werecognize that stable IT systems and the protectionand management of our information assets are criticalmanagement issues.We implement information security measures basedon our Information Security Regulations and ourInformation Security Response Standards. Recentmeasures include adopting thin-client terminals for allemployees as part of our telecommuting infrastructuredevelopment, the dispersal of our servers andestablishment of redundant communication routes,and the implementation of multiple redundancies toprotect against cyberattacks. We also are enhancingemployee enlightenment activities. Moving forward, wewill continue to strengthen our security based on anassumption of zero trust (nowhere is safe).

COVID-19 Response

From January 2020, our Group initiated BCPmeasures aimed at ensuring the safety of allemployees and their families as well as all ourstakeholders amid the COVID-19 pandemic.We reinforce hygiene measures throughout theworkday, including handwashing, the use of masks,and temperature checks, restrict business traveland other work-related movement, adopted timeshifts and telecommuting, and we take advantageof web-based meetings. Our offices are equippedwith ultrasonic diffusers that spay an MA-T-basedsolution that is effective against viruses. We alsoinstall disinfectant spray and partitions. Whennecessary, prior to visiting customers, we receivePCR tests or antibody testing. At our logisticsfacilities, we are implementing measures to limitinfections as much as possible, including requiringdaily temperature checks, the use of masks, andthe dispersal during lunch breaks.As a company dedicated to supporting medicaland research institutions, we are committed topreventing the spread of infection while working tofulfill our responsibility of providing supplies tomedical workplaces.

Compliance

Basic Policy

We created a compliance manual that we apply to allAS ONE directors and employees, and conductplanned education and training activities.The Company deals severely with any director oremployee in violation of these standards based on theprinciple of rewarding good work and punishing baddeeds.

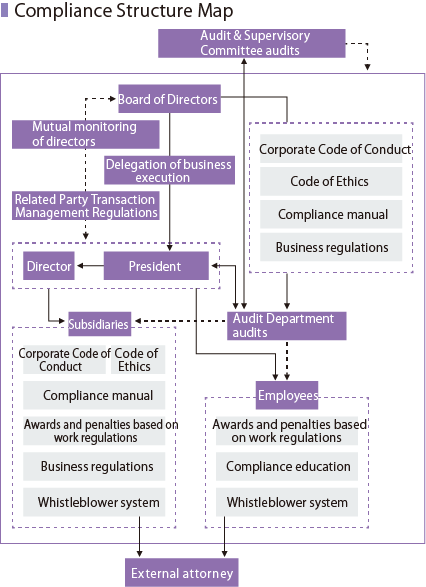

Compliance Structure

All matters related to compliance and implementedresponses are shared with the Board of Directors andat other important meetings, after which we outlineand implement response measures as needed.We conduct regular compliance training for allemployees to promote compliance awareness andpractices.In addition to the whistleblowing hotline establishedin the Internal Audit Department, we also added awhistleblowing hotline linked to an external attorney toincrease whistleblower privacy.

Conduct Guidelines

AS ONE has created a corporate code of conduct tobetter reflect our management philosophy ofInnovation and Creation and our management policyof pursuing customer satisfaction.

1.Ensure product and service quality and safety

We make every effort to earn customer trust and satisfaction by ensuringquality and safety to provide products and services with value. We alsowork continuously to improve that value.

2.Comply with laws and corporate ethics

We comply with relevant laws and corporate ethics to ensure legal andappropriate business practices

3.Conduct fair trade

We do not allow unjust transaction restrictions or conduct transactionsbased on unfair methods.

4.Do not offer excessive gifts, entertainment, political contributions, or donations

We do not offer excessive gifts and entertainment. We comply with lawsand do not make political contributions or donations deemed inappropriateby society.

5.Reject anti-social forces

We take an unwavering stance against anti-social forces or organizationsthat threaten social order or safety, and will never submit to or acquiescesuch forces.

6.Ensure appropriate handling of personal information

We handle personal information and all other information legally andappropriately.

7.Provide appropriate information disclosure

We provide timely, appropriate information disclosure to customers,shareholders, investors, and all other stakeholders.

8.Act as a good member of society

All AS ONE directors and employees think about whether or not our actionsare in line with rules to ensure we act as good members of society.

9.Respect employee creativity and individuality

We work to maintain a work environment that allows each employee toapply their unique creativity and individuality, and to promote a motivatedand energetic approach to implementing our management philosophy andmanagement policy.

10.Stop sexual harassment and power harassment

We will never accept or allow sexual harassment, power harassment, orany other forms of harassment.

11.Protect the environment

We maintain an awareness of our responsibilities as good corporatecitizens, and work to maintain a balance of prosperity for human societywhile working tirelessly to protect and conserve a healthy globalenvironment.

12.Respect human rights

We respect all human rights mandated by law and outlined in the UniversalDeclaration of Human Rights and international labor standards. We do notdiscriminate based on race, skin color, creed, religion, nationality, age,gender, or place of birth. We also do not accept or allow suchdiscrimination.